Our Service

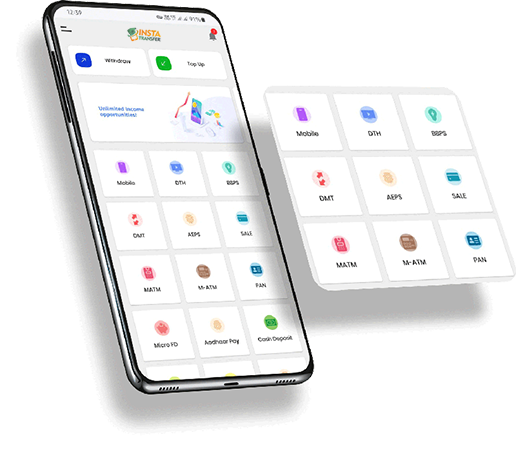

NSDL Kiosk Banking

Limit grant on holidays too

MICRO ATM is also available for cash withdrawal facility

Only FINTECH company offering MICRO ATM In the market

Only company offering micro insurance product to the merchants

Unlimited cash withdrawal from MICRO ATM without any MDR charges

Immediate, unlimited and free IMPS settlement for all AEPS and MICRO ATM withdrawals

Only remittance company offering instant debit card on account opening

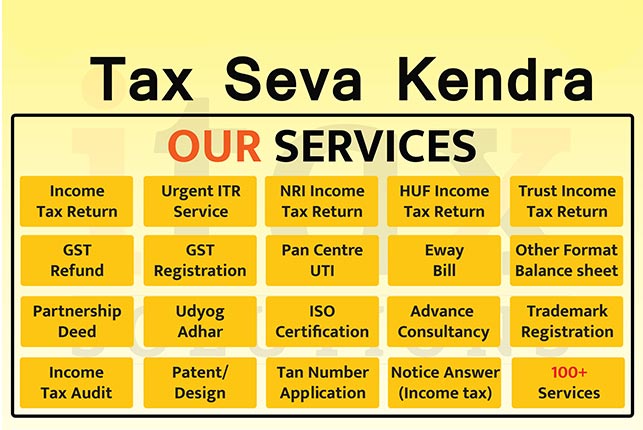

Our Service

BOB Kiosk Banking

Bank of Baroda (BOB) is an Indian nationalized banking and financial services company

under the ownership of the Ministry of Finance, Government of India…. The Maharaja of Baroda, Maharaja Sayajirao Gaekwad III, founded the bank on 20 July 1908 in the Princely State of Baroda, in Gujarat.

Bank of Baroda CSP or Bank of Baroda Kiosk banking is a concept that has been designed under Public Private Partnership. Here the BOB Kiosk is a private entity that

represents Bank of Baroda in a local area where banks are not present in brick and mortar due to scarcity of resources.

Our Service

SBI Kiosk Banking

State Bank of India which has the largest branch network in the country invites eligible

individuals/ NGOs/Companies (other than NBFCs)/ other entities to join hands with us

to take banking to all.

SBI Kiosk transactions are bio-metrically secured; printed acknowledgment for each transaction is issued to the customer and has End-to-end process of account opening & transactions online. Micro savings and Micro remittance are done through No Frills

Savings Bank Account.

Business, Eligibility, Benefits, Purpose

What is Kiosk Banking?

Banking and its associated services have become a part of one’s day-to-day life. Everything from checking balances or depositing cheques, the bank does it all. In the era of developing tools that make our lives a little easier, banks have also opted for tools such as ATMs.

ATMs’ provision has simplified processes like money transfer and withdrawal of cash, which is why it gained popularity amongst the average working individuals that could access money on the go. But, such kind of facility has been far out of the reach of the minority or poverty-ridden sections of the society. This section majorly comprises the

daily wage earners that are unable to reach out to the banks for availing the fundamental services.

To bridge this gap, the Reserve Bank of India introduced the much renowned Kiosk Banking system.

Kiosk Banking and its meaning

The word KIOSK stands for Kommunikasjon Integrert Offentlig Service Kontor, and it denotes a small open-fronted hut or a cubicle. In terms of banking, a Kiosk is a service introduced to cater to the banking needs of the low-income sections of the society by bringing the common banking services near their locality.

The kiosk allows the individuals to access the banking facilities such as cheque transfer, transactions, balance inquiry, cash deposit or remittances, etc. They can do all this without having to go to a banking branch. This benefits the LIGs (Low Income Groups) as they get all the services without having to visit the bank. As these individuals are incapable of maintaining a minimum amount in their bank accounts, Kiosk provides them with the ability to maintain their bank accounts without a fret.

Components of Kiosk Banking

Generally, the Kiosk is set-up as a booth in any local shops or retail points available in

the neighborhood of villages. This ensures an enhanced reach and greater accessibility

to customers.

There are two components of a Kiosk Banking system:

Customer Service Point (CSP), and

Kiosk Machine

Customer Service Point: It is a counter created in the shop along with the Kiosk booth that enables efficient connectivity to a corresponding private or public bank. The customers may contact CSP to raise concerns regarding any transactions or account procedures and get solutions.

Kiosk Machine: The second portion of the Kiosk booth is the Kiosk Machine that allows the user to perform transactions and other banking services such as cheque deposits, balance inquiries, etc. It consists of Barcode Scanner, Cash Acceptor, Integrated Full-Page Thermal Printer, Integrated Speaker, Keyboard with Trackball, Touch and Non-Touch Display, Video Camera.

Who can start a Kiosk Banking system?

The people eligible to apply for setting up a Kiosk Booth include shop owners, retailers, small business owners, or even individuals.

The eligibility criteria for Kiosk Banking comprises of:

Minimum age limit: 18 years

Qualifications: The individual should have cleared a senior secondary examination

Minimum space required to set up the Kiosk booth: 100-200 Sq. Ft

The applicant should ensure provision for computers and the internet.

The shop owners or small business owners can incorporate a Kiosk booth alongside a CSP for which the small business should have MSME registration. The equipment required for establishing a Kiosk shall be provided by the bank along that includes a Kiosk machine, a machine for scanning fingerprints, and software compatible with computers.

The procedure of Kiosk banking

Initially, the customer shall open a No-Frills Account.

Next, he/she shall proceed with KYC verification.

The KYC verification is done by the corresponding banks, where they verify the submitted documents.

Once the KYC process has been completed, the individual is free to use his/her account and perform transactions.

Documents Required

The corresponding bank’s application form filled.

Proof of Identity: Aadhaar, Voter’s ID, Driver’s license

Address proof of the retail shop where the Kiosk is to be set up: Electricity or other amenities bill

Applicant’s Ration card

Applicant’s recent photographs - 2

After gathering knowledge regarding Kiosk banking fundamentals, let us find out more about the features and benefits of Kiosk Banking.

Kiosk Banking and its impact on Low-income groups

Features of Kiosk Banking

As the Kiosk Banking system is aimed at providing for the LIGs, the function and layout

of these systems are simple. The fundamental features of Kiosk Banking are as follows:

The individuals are allowed to make transactions only in the form of cash.

Under Kiosk Banking, the individual is allowed to make a maximum transaction of Rs.10,000 per day.

Kiosk Banking offers individuals to open a Fixed Deposit or a Recurring Deposit account to develop an investment or savings.

The cash transactions can be performed with thumb impressions, and there is no compulsion of the accountholder’s signature. This also ropes in the convenience of the transaction for minority sections.

Kiosk Banking provides the customers a No-Frills Account: Under such a bank account, the accountholders don’t have to follow a minimum balance custom. They are allowed to open as well as operate a bank account with zero balance. This is helpful for those daily-wage workers who work on a per-day income.

Kiosk Banking provides the customers with an upper limit of Rs.50,000 for their bank accounts. In case the total balance of the account exceeds this amount, then the bank account shall be converted to a regular bank account.

Kiosk Banking also provides the accountholders an insurance coverage. This coverage is sanctioned under a scenario where the account holder gets in an accident. The insurance amount offered goes up to Rs.10,000.

Benefits of Kiosk Banking

One of the main objectives of starting the facility of Kiosk Banking was to support the

financial needs of the low-income grade individuals and to provide them with benefits

like:

Feasibility: Kiosk Banking has the obvious advantage of being convenient and accessible to even the country’s most remote villages. It helps spread the banking network by an astounding range where the people working in villages can access banks’ facilities. As the Kiosk is installed in the form of booths in the local shops, the people are not required to wait in long queues to get what they want.

No limits on minimum balance: Under a Kiosk Banking system, the candidate is allowed to open a new bank account with a zero balance. There is no necessity for a minimum account balance to use the bank services. This is good for the LIGs and minimum wage workers where they can open and manage a bank account without worrying about the account balance.

NEFT and RTGS: Individuals can use kiosk Banking to perform NEFT and RTGS type of transactions with ease, and they can do so without visiting the bank branch.

Easier banking processes: Under Kiosk Banking, procedures such as KYC and document verification are much swifter and are hassle-free.

Internet Banking: Kiosk Banking also allows the customers to utilize net-banking and make online payments or online transactions with ease.

User-friendly services: Kiosk Banking provides extensive working hours, zero to nil transaction charges, and a thumb impression for transactions that allow a more comprehensive and pleasant user experience.

As a means for business: Nowadays, Kiosk Business Banking has gained momentum where several small and independent businesses operate with a Kiosk-based system. The Kiosk booths have evolved as a source of business development.

The shop owners or retailers that incorporate Kiosk booths in their shops also achieve a sense of income boost by the commission earned via cash deposits and withdrawals made using Kiosk.

Kiosk vs ATM

Kiosk Banking systems were established after the development of ATM. As a result, there are some differences between Kiosk and ATM which can be explained through the services offered by Kiosks such as:

Kiosks offer account inquiries such as checkbook requests that are not offered by ATMs.

Kiosks also provide the customers with customer support tools that connect with the bank’s help desk directly.

Kiosks provide MIS reporting, which is not the case with ATMs

Another striking difference between Kiosk and ATM is that Kiosk allows a cheque deposit facility, unlike ATM.

Kiosks also offer an Internet banking facility for the user to carry out online transactions.

Kiosks also have a Customer Service Point or CSP to help assist the customers.

Download Insta Transfer application from Google play-store

Signup and create your account. In 48 hours you can start your own business and increase your income